Europe becomes the world’s largest crypto market as UK adoption surges

EUROPE has been crowned the world’s largest crypto market with investment in decentralised finance (DeFi) driving a surge in transaction volumes.

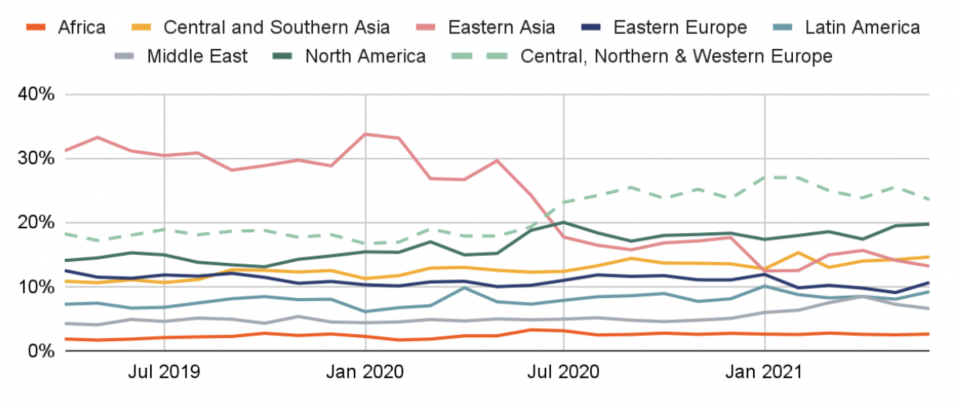

European countries received more than $1tn (£734.4bn) worth of cryptocurrency in the space of a year, which represents 25 per cent of global activity, according to a new study by Chainalysis.

The UK was the leading European country for crypto activity between June 2020 and July 2021, with $170bn worth of digital assets received.

Kim Grauer, the Director of Research at Chainalysis dubbed the UK an emerging “global professional cryptocurrency hub”.

“The region in general – Central, Northern, & Western Europe – has the biggest cryptocurrency economy of any region that we study, surpassing East Asia following China’s regulatory crackdowns earlier this year,” Grauer said.

Surging crypto trade volumes are being driven by interest in DeFi, crypto projects and applications which offer decentralised versions of the financial services traditionally offered by banks.

Analysis of 34 European countries showed that, in each of the nations, investment in Ether and wrapped Ether – tokens used to access a vast ecosystem of DeFi projects – attracted more capital than any other market segment.

DeFi accounted for the majority of capital invested by large institutional, retail and professional investors across the continent. Gauer confirmed that the UK’s breakaway crypto transaction volumes were “in large part driven by DeFi activity among large, institutional traders”.

In the UK, the flagship cryptocurrency – Bitcoin – accounted for 28 per cent of crypto transactions while the challenger currency Ethereum made up around 40 per cent. DeFi projects accounted for the majority of UK crypto activity with 49 per cent of revenues arising from DeFi protocols.

The comments chime with data showing that DeFi adoption is highest amongst institutional investors and professional traders who have the funds to experiment with riskier projects.

The Chainalysis report found that large institutional cryptocurrency transaction value helped to drive the growth of the European market, jumping from $1.4bn in July 2020 to $46.3bn in June 2021 as banks and financial institutions increased their crypto exposure.

It comes as data released yesterday revealed that more than six in ten institutional investors and wealth managers from the US, UK, France, Germany, and the UAE currently don’t have any exposure to cryptocurrencies and digital assets, and expect to invest for the first time within the next year.

Read more: Exclusive: Institutional investors and wealth managers increasingly ‘test’ crypto market